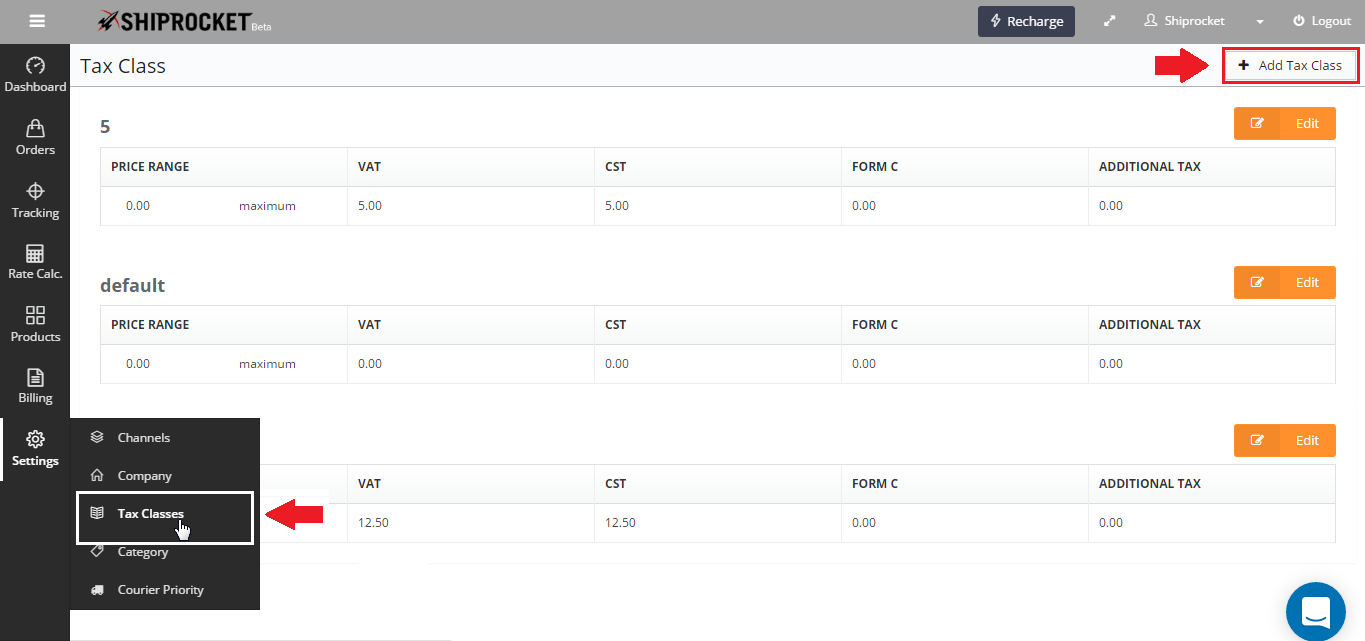

Tax Classes

Tax Classes are defined in the system to avoid mentioning Tax applicable on the product every time an order is invoiced.

3 Tax Classes are already predefined in the system “5”, “Default” and “12.5”

You can edit or add a new tax class by click on “Add Tax Class” button.

A Tax Class contains 4 components:

- VAT

- CST

- Form C

- Additional Tax

Either VAT or CST should be applied is automatically calculated by system based on Pickup and Delivery Address.

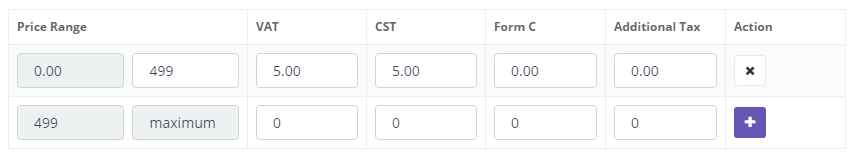

Defining Price Range:

You can also define Tax to be applicable based on Price of the product in an order.