About GST

Goods and Services Tax (GST) is a destination-based indirect tax levied on the sale of goods and services in India. It is collected from manufacturers, wholesalers, retailers, and consumers at the point of consumption and is charged on every value addition.

The GST act was passed in the parliament on 29th March 2017, with an objective to simplify taxation for businesses by replacing all indirect taxes like central excise duty, service tax, VAT, octroi and surcharges.

Forms of GST

State Goods & Services Tax (SGST)

Levied by a state government on transactions done within state boundaries

Central Goods & Services Tax (CGST)

Levied by the central government on transactions done within state boundaries

Integrated Goods & Services Tax (IGST)

Levied by the central government on interstate supply of goods & services

How to Calculate GST

Using Formulae

If price is GST exclusive:

GST Amount = (Value of supply x GST%)/100

Total selling price = Value of supply + GST Amount

If price is GST inclusive:

GST Amount = Value of supply – [Value of supply x {100/(100+GST%)}]

Learn More About GST

How to Register for GST Online in India [Step by Step Complete Guide]

The Goods and Services Tax, also known as GST is a unified tax system of India that subsumes all various…

Know more

Impact Of GST On Exports Of Goods & Services In India

The government of India introduced the Goods and Services Tax (GST) in 2016 across the country. It was a move…

Know more

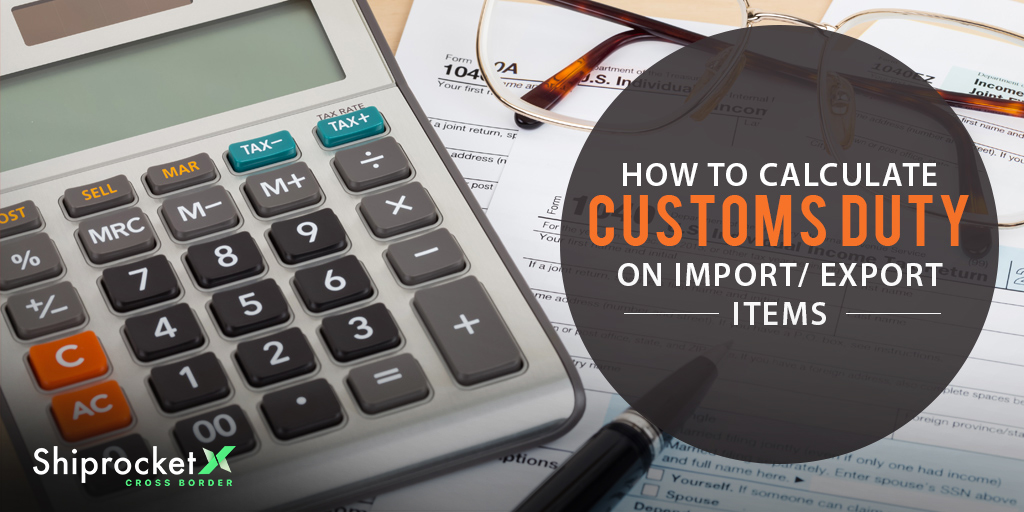

How To Calculate Customs Duty Post GST Introduction In India

Whenever any merchandise is imported into the country or exported to other regions, the government levies an indirect tax on…

Know moreFrequently Asked Questions

This GST calculator can be used by buyers, manufacturers, and wholesalers.

Yes, one just needs to enter the cost of production/cost of goods, profit margin, and rate of GST.

All they need is to enter the net price before GST and then select the rate of GST.

Our GST calculator gives accurate details of your tax amount and total selling price using minimum time and effort.

Reduce Shipping Cost By Upto 20%

Simplify shipping by leveraging our AI-enabled technology <br>& multi-carrier network.

Sign-Up Now