*T&C Apply.

Signup Now

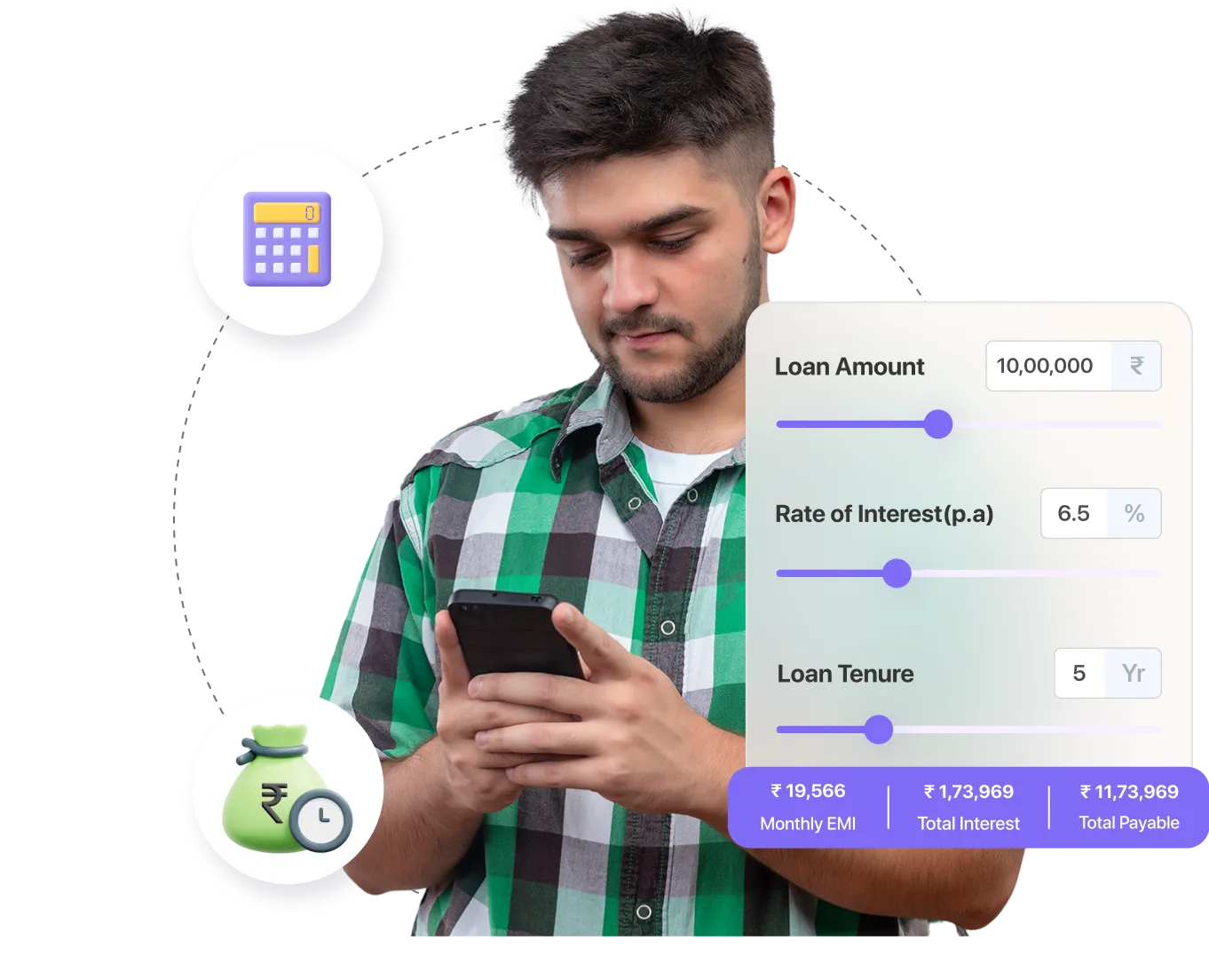

Check your loan terms in 3 steps

1

Step 1

2

Step 2

3

Step 3

Your total payment will be

₹11,73,968.89

Monthly EMI ₹19,566.15

Total Intrest ₹1,73,968.89

Principal Amount ₹10,00,000.00

Disclaimer: This EMI Loan Calculator solely serves as a representation tool. It does not constitute an offer or solicitation for financial transactions. Results are subject to various factors, including the assumptions you provide. Shiprocket or any of its affiliates/group companies shall not be responsible for any loss or damage that may arise to any person from any inadvertent errors in the EMI Calculator’s information.

Master your Finances

-

Financial preparedness

Understand the affordability of the loan and align it with your financial capabilities

-

Budget management

Assess how the loan fits into your monthly budget, preventing financial strain

-

Interest awareness

Get the total interest payments over the loan tenure and make informed decisions

-

Smart decision-making

Compare different loan options and choose the one that best suits your financial goals

Make that next big move with

funds upto ₹30 Crores within 2 days

Apply Now

Designed to

work together

Use the emi calculator with other Shiprocket

solutions for the next level of business growth

Key variables in business loan EMI

Principal Loan Amount

The initial sum borrowed, influencing monthly instalments; higher amounts result in increased installments.

Interest Rate

The percentage charged on the borrowed amount, is influenced by credit performance and business track record.

Loan Tenure

The duration agreed upon for repayment, affecting monthly instalments; shorter tenures increase EMIs but reduce interest.

Discover the latest logistics trends and pro tips

- Frequently Asked Questions

An invoice is a bill that requests payment for products or services, detailing what was purchased, its cost and the total amount due.

The actual monthly EMI may vary depending on the financing agency or bank, as certain charges can differ. Based on the provided figures, you can expect a monthly EMI of around ₹48,000.

EMI = P x r x (1+r)^n / (1+r)^n-1

Where:

P is the principal loan amount (₹10,00,000),

r is the monthly interest rate,

n is the loan tenure in months

You can send the invoice using the method that suits you and your customers best. Options include, but are not limited to:

Email

WhatsApp

Other platforms

Self-employed individual

Private limited company

Limited liability partnership firm

Proprietorship firm

Partnership firm

Hindu united family

Trusts and societies