Handling eCommerce Import Requirements In India

A business based in India purchases goods or services provided by a company based in another country called import. Imports help countries source products for domestic consumers that might not be available within the country.

Take a look at what is import and how to tackle the import process in India.

What Is Import?

Import is an integral part of international trade. Shipping by sea and by air is the most popular mode of transportation for importing goods in a country. Importers can make freight shipping by air or ocean using a Full Container Load (FCL) or Less than Container Load (LCL).

The large consignment that takes up the entire container space is called an FCL shipment, while the small consignment that shares the container space is called an LCL shipment. An FCL shipment has a shorter transit time than an LCL shipment. Importers can deliver their cargo by the mode of air, which is a bit costly than shipment by sea mode.

In this blog, we will be discussing import requirements in India. So if you are planning to import goods in India, this post will explain import requirements, customs duties, taxes, and other processes you will be handling.

What Is Import Duty In India?

All products imported in India have to pass through the procedure of customs to ensure proper evaluation. The customs authorities charge the appropriate tax and also check the illegally imported goods. It is important to note that import duty in India is a tax imposed by the government on goods from other countries. Also, importers have to acquire the IEC number for the commercial use of imported goods. There is no requirement to have an IEC number if the goods are imported for personal use.

The import duty varies from product to product and is categorized based on the material type and from where it is acquired.

In India, import duties are collected by the Central Board of Indirect Taxes and Customs (CBIC) and are governed by the Customs Act, 1962, and the Finance Act.

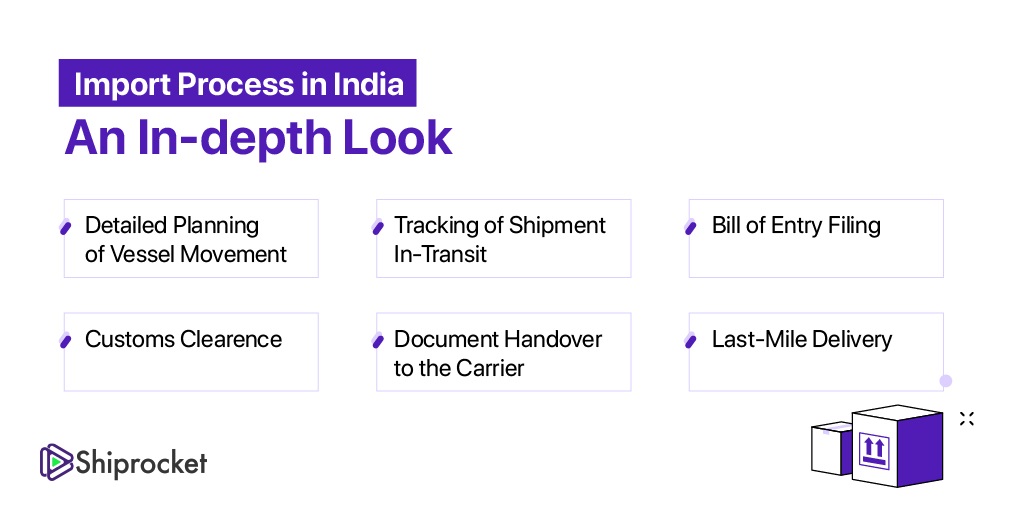

What Is Import Process In India?

Step 1

Making The Shipping Arrangements

In this process, the importer collects container details, shipping instructions, and documents from the exporter to finalize the deal and makes shipping arrangements.

In the next step, the exporter of the origin country needs to submit the bill of lading (B/L) to the importer.

In case if the bill of lading is surrendered at the origin, the exporter also needs to share Surrender details unless the shipment is under “documents against payment” or letter of credit).

Confirmation of local taxes and charges for import services are paid by the exporter and sent to the importer.

The Shipped on Board confirmation is required at this stage to approve and plan vessel movement.

Step 2

Shipment In-transit Activities

For shipment in transit, the destination agent informs the importer of the shipment process and any delays.

Before the shipment arrives at the port of the importer’s destination, the carrier submits an Import General Manifest (IGM) with the customs department of India. This document includes details of shipments carried by ship along with their bill of lading numbers.

The Cargo Arrival Notice (CAN) is also a mandatory document that the carrier needs to submit to notify the importer about the shipment weight, description of the goods, number of packages, and charges, if any.

Step 3

Port Of Destination Activities

In this process, the import shipments, once they arrive at the port of destination, are off-loaded and loaded on trailers and moved to a container freight station for the process of customs clearance.

Step 4

Bill Of Entry Filing For Import Clearance

The Bill of Entry (BOE) should be filed within two days of the shipment’s arrival at the destination port. It is one of the essential documents for the clearance of import requirements in India.

The agents mark the Bill of Entry before the goods enter into a country before their consumption.

For the Bill of Entry filing in India, the customs agent can enter the details on the official website of the Central Board of Indirect Taxes and Customs.

Step 5

Cargo Customs Clearance Activities

After the Bill of Entry number is generated, the customs department evaluates the process and assesses the duty applicable to a particular cargo based on commodity classification.

The customs department checks if the cargo is restricted or prohibited for import in the country or required licenses or permissions.

If the customs department doesn’t find the cargo valid, the shipment is sent to evaluate the goods.

After the open evaluation of imported goods, the customs officer endorses the bill of entry with a “Pass Out Order” stamp.

The importer needs to complete the payments and taxes for customs clearance.

Step 6

Document Submission Requirements

For the import customs clearance, the importer must submit the purchase order, bill of lading, license for import, list of package items, declaration copy, certificate of origin, letter of credit, bill of entry number to the carrier.

Step 7

Delivery Of Imported Goods

The delivery of imported goods is an essential step of the process. It’s the importer’s responsibility to fulfill the last-mile delivery of shipment containers.

How Import Duty Is Levied?

Online stores that import goods in India attract an essential customs duty of 10%. Also, have to pay goods and services tax (GST) as fixed by the government.

Therefore, for most eCommerce goods, total import duty payable = Basic Customs Duty + Customs Handling Fee.

How To Pay Import Duty In India?

After the clearance of imported goods from the Indian Customs Department, follow these steps to pay import duty:

- Visit the Icegate e-payment portal

- Login to the portal using your credentials or by entering your Import/Export Code

- Go to the e-payment option to check all your unpaid e-challans or payments

- Select the challan/payment you wish to pay

- Choose your bank/debit card

- You will be redirected to the bank’s payment gateway to make your payment

- After the payment is done, you will be redirected to the Icegate portal.

- Finally, take the print of your payment receipt

For GST payments, you can visit the GST portal or pay in cash.

Register with Shiprocket to make your eCommerce shipping and import procedures easy. We provide trusted logistics providers and cargo tracking facilities from pick-up to drop-off.