What Is A Tariff? What’s The Purpose Of A Tariff?

We live in an era where online businesses are thriving on open global trade. International trade agreements always benefit both nations. Here’s what a tariff is and how it regulates international trade.

Many nations want the trade to be fair rather than free. Therefore, they impose taxes on the goods and services imported from another country. People commonly refer to this tax as a tariff.

According to the Ministry of Commerce & Industry, India’s exports increased to 35430 Million USD in July 2021. The best time to take your eCommerce business global is now.

But before that, you must estimate your costs. A tariff is an essential component of your costs imposed by the importing country.

Let’s deep dive into what a tariff is and why it exists:

What Is A Tariff?

A tariff is a tax levied on goods or services imported from other countries. Governments introduced tariffs in global trade primarily for restricting trade. Many products we buy online in India have components assembled in other countries, or made entirely outside India.

Tariffs aim to increase the price of the goods and hence, reduce imports. Not just this, tariffs are also a handy tool for governments to safeguard the domestic industry.

For instance, the Government of India recently increased the import duty on toys from 22% to 66%, as mentioned in Budget 2020. It aligns with their ongoing “Vocal for local” campaign and “Make in India” initiative.

The government hopes that the added cost will make the imported Chinese toys much less desirable. This scenario will provide a boost to the domestic toy industry, both online and offline.

By now, you must have gotten a clear idea of what a tariff is and why governments impose it. But are these the only underlying objectives? Let’s find out in detail:

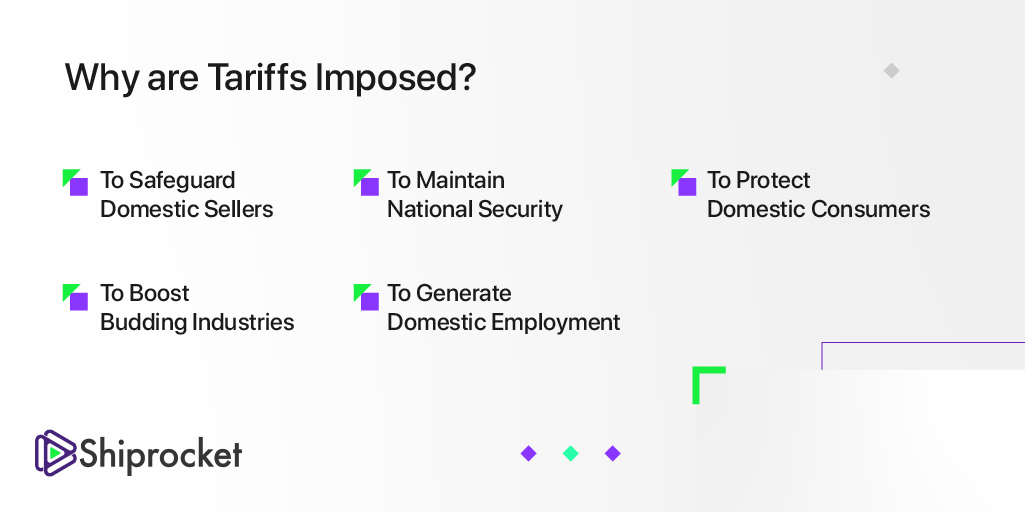

What Is A Tariff’s Purpose?

There are a plethora of reasons why governments levy tariffs on imported goods. Some of the most common ones are:

Safeguarding Domestic Sellers

Global players may usually deploy unfair trade strategies to gain market share. What is a tariff? A protector of domestic eCommerce sellers that saves them from going out of business

As the tariffs increase the price of the imported products, the possibility of a disruptive demand for those products reduces. Result? The domestic industry gets a fair chance to flourish.

Maintaining National Security

Some industries have strategic significance concerning national security. Therefore, it becomes vital to protect them from getting overly dependent on imports.

For example, if a particular industry provides goods or services essential for national defense, a government imposes tariffs on global competitors and encourages local manufacturing.

Protecting Domestic Consumers

If you care about the consumers, you care about what a tariff is and how it protects them. You’d want to protect the domestic consumers so they, in turn, protect your eCommerce business.

Some cheap imported goods may be dangerous for the consumers. For example, inexpensive and low-quality Chinese gadgets might be prone to overheating and exploding.

By imposing tariffs, governments want to increase the prices of such products and curb their excessive use.

Boosting Budding Industries

Tariffs also stimulate growth in the budding and early-stage domestic online sellers. They protect them from unfair global competition.

Research says that 90% of Indian startups fail within the first five years of inception. The tariffs act as a fertilizer that helps the seed of a domestic eCommerce business grow into a globally competitive tree.

Generating Domestic Employment

Lastly, supporting the domestic eCommerce sellers also goes a long way in preventing a potential increase in unemployment.

If the domestic industry finds it hard to compete against global competitors, the government may use tariffs to promote the consumption of local products. It is to provide an indirect but significant stimulus to job creation.

Now that you understand what a tariff is and why it exists, you should also know that it has some downsides.

The Downside: A Spike In Your Costs

A high tariff means you have to pay more import duty, as levied by the importing country. If you’re shipping your products outside India, you must brace your eCommerce business against high costs.

As a result, your products reach far, but you also get far away from profits. You start to wonder whether taking your online business global was a good idea in the first place.

Interestingly, tariffs can also reduce the buying power of the consumers in the country that imposes the tariffs. It’s nothing but yet another ache in your head.

Guess what, we’ve got a solution.

Reduce International Shipping Costs

As an eCommerce seller, tariffs may be beyond your control, but your shipping costs aren’t. Despite the taxes, you can make more profits when you ship your products internationally at a lesser price.

How about cutting your monthly freight bills in half?

Shiprocket is India’s #1 shipping solution. It helps you to reach over 220 countries with top courier partners like FedEx, DHL, Aramex, and more. Also, integrating with global marketplaces like Amazon and eBay is easier than ever.

You get all this and a lot more for shipping rates as low as ₹110/0.5Kg. On top of it, you can start shipping without any monthly fees or set-up charges.

Just recharge your wallet and get started. Begin now.