What is a Shipping Bill and Steps to Generate it?

- Why Shipping Bill is Necessary for International Trade?

- What Exactly is Included in the Shipping Bill?

- Online Procedure of Filing Shipping Bill from ICEGATE

- Six Different Types of Shipping Bill

- Offline Procedure of Filing Shipping Bill

- Important Steps Before Generating the Shipping Bill

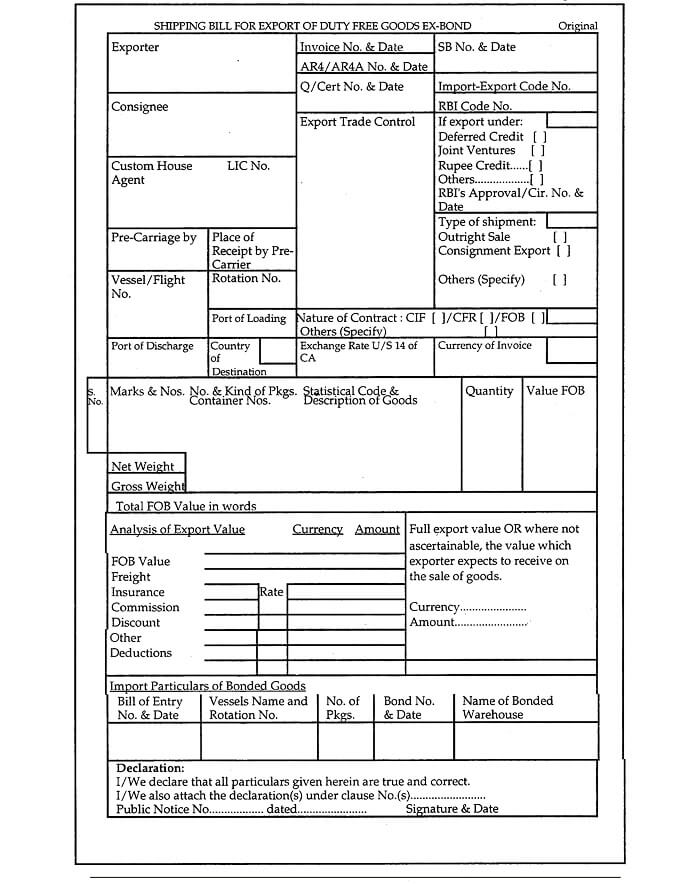

- Format of Shipping Bill

- Revised Format of Shipping Bill

- Easy eCommerce Exports with ShiprocketX

While shipping goods from one country to another, a supplier has to go through various formalities such as verifying the accuracy of the declared goods, calculating duties & taxes, and ensuring compliance with export regulations. A shipping bill facilitates this entire process for you.

It is the primary document on the basis of which the customs office gives permission to export. You must file the shipping bill to transport your goods via road, air or ocean freight. It contains all your shipment details, such as the vessel name, the port at which goods are to be discharged, the exporter’s name and address, the country of final destination, etc.

Why Shipping Bill is Necessary for International Trade?

Filing a shipping bill allows exporters to obtain customs clearance and initiate the shipping process. The Customs Service Centre issues a ‘Let Export Order’ and a ‘Let Ship Order’ after carefully examining the bill. The shipping bill also ensures the products reach the importer in good condition.

What Exactly is Included in the Shipping Bill?

Following is the information included in the shipping bill:

- Vessel name used for transportation.

- Details of exporter, customs agent, and buyer or importer.

- Cargo particulars, including the nature of the goods and their gross & net weight.

- Port of discharging and loading with transportation details.

- Information related to export duty and GST.

- Invoice details, including the nature of payment, number of commercial invoices, and bill value in both currencies.

- Duty Drawback details.

- Container numbers used for shipping.

- The final destination (the country where the goods are being transported) and the specific port of that nation where goods will be discharged.

- The insurance amount and FOB (Freight on Board) price of the exported items.

- Nature of the products exported.

- Package details, including the number of packages and their marks for identification

- Addresses of the importer and exporter.

Online Procedure of Filing Shipping Bill from ICEGATE

The procedure for filing a shipping bill in India is done through the ICEGATE platform. To obtain the shipping bill from ICEGATE, you need to perform the following steps.

If you are a first-time user on the ICEGATE platform, the registration process is mandatory. Being an exporter, you need to register on their website (ICEGATE) with the IEC (Import Export Code) or CHA (Customs House Agent) license number and AD Code (Authorized dealer Code) of the respective bank.

After that, you need to sign in to ICEGATE, fill in the required details, and submit the necessary documents. The paperwork needed may vary depending on the goods you intend to export, like duty goods, dutiable goods, duty-free goods, under drawback, and ex-bond.

After document submission, the verification process starts and finally you will be issued ‘Let export Order’ by the officer. Once you receive it, retain the printed copies of the verified shipping bills along with the shipping bill number.

Let’s say you have applied for an ICEGATE shipping bill, but it is still being processed. Now, how do you check the current status? Following these steps to get an update:

- Login to ICEGATE using your login credentials.

- Click on the ‘Job Status’ link on the left menu of available services.

- Click on ‘Shipping Bill (24Hrs)’ On the ‘Job Status’ page and select the appropriate location from the drop-down.

- Submit the necessary details.

You can view the current status of all shipping bills filed from the selected location in the last 24 hours. These details include job number, job date, and Customs location name, along with details of the various stages of the shipping bills.

Six Different Types of Shipping Bill

If you want to build smooth export strategies, then you must know about the different types of shipping bills. Let’s understand each kind that makes it easy for exporters to handle paperwork:

1. Drawback Shipping Bill

The drawback shipping bill is needed when goods and materials are imported to a country for processing, and the customs duty that has been paid can be refunded by the government. This is generally known as a drawback shipping bill, which is printed on green paper, but once the drawback has been paid, it is printed on white paper.

2. Dutiable Shipping Bill

This type of shipping bill is printed on yellow paper that depicts goods are for export on the export duty payment. It may or may not be entitled to duty drawback.

3. Shipping Bill for Export of Goods (DEPB Scheme)

The shipping bill for the export of Goods comes under the Duty Entitlement Passbook Scheme (DEPB) and is Printed in blue. It is for an export incentive scheme implemented by the Indian Government for the country’s exporters.

4. Duty-Free Shipping Bill

Duty-free bills are solely for goods exported without paying any export duty and are printed on white paper.

5. Coastal Shipping Bills

Coastal shipping bills are required when goods are transported within the same country, that is, interstate, from one port to another.

6. Ex-Bond Shipping Bill

Ex-bond shipping bills are used for products previously imported and stored in bonded warehouses and are now being exported.

Offline Procedure of Filing Shipping Bill

The offline procedure of filing shipping bills has become outdated these days, given the online procedure of filing shipping bills is much more convenient and fast. However, in some cases, exporters still prefer the manual filing process. The documentation remains the same in the offline procedure. The only difference is that you have to visit the customs office to submit all the documents.

Important Steps Before Generating the Shipping Bill

Before the customs department generates the shipping bill, certain things should be taken care of to complete this process.

For example, if the exported goods fall under the Duty Exemption Entitlement Certificate or DEPB (Duty Entitlement Pass Book Scheme), the processing will be done under the DEEC group.

The customs duty officer also has the right to assess the value of the goods. The officer may ask you to submit the samples of the material and send them for the tests.

Once the material inspection is done, the customs department issues the “Let Export Order”.

Format of Shipping Bill

Here is the format of the shipping bill. Make sure you follow the same structure while submitting the documents enlisted below:

- Invoice

- Packing list

- Acceptance of Contract

- Indent

- QC Certificate

- Export licence

- Port Trust Document

- Letter of Credit

- Any other (as specified)

Revised Format of Shipping Bill

The following format has been amended/substituted:

| Form | Particular | Copy Type |

|---|---|---|

| Form SB I (regulation 2) | Shipping Bill for Export of Goods | Original |

| Form SB I (regulation 2) | Shipping Bill for Export of Goods | Quadruplicate(export promotion copy) |

| Form SB III (regulation 3) | Bill for Export of Goods | Original |

| Form SB III (regulation 3) | Bill for Export of Goods | Quadruplicate(export promotion copy) |

Easy eCommerce Exports with ShiprocketX

Are you ready to push your boundaries? Get onboard and start your export journey today with ShiprocketX. This platform is designed to process international shipments more smoothly and quickly. Moreover, it lets you integrate multiple marketplaces and carriers into one single shipping platform.

Choosing ShiprocketX also allows you to calculate international shipping rates immediately. This enables you to plan your shipments instantly without spending much time on getting the quotation. Rest assured, you will get the top courier partners at an affordable rate, as Shiprocket wants to avoid burning a hole in your pocket.

Final Say

The shipping bill is one of the most important documents the exporters have to acquire from the customs clearance department. It is always advisable to get the help of a reputable, well-organised and affordable shipping service provider, such as Shiprocket or CHA, to complete the formalities of registration and export documentation without any hassle!