What Is The Import Export Code (IEC)?

Import Export Code (also known as IEC code) is a 10-digit identification number that is issued by the DGFT (Director General of Foreign Trade), Department of Commerce, Government of India. It is also known as the Importer Exporter Code. An individual or a business entity must obtain it to engage in import and export activities in the Indian territory. There are certain processes and conditions that you need to fulfill to obtain the Import Export Code (IEC). You also need to adhere to certain regulations. Once you fulfill the conditions, you can get the IEC code from the DGFT office. It has several regional offices throughout the country. You can get it from the nearest zonal or regional office. In this blog, you will learn what is IEC code, why is it required, how to apply for it and more.

The Need for Import Export Code

As mentioned above, importer exporter code is a mandatory requirement for those involved in international trade in India. Here is a closer look at the need for this code:

- IEC is mandatory under the Foreign Trade Act, 1992. It ensures that those engaged in international trade adhere to the standard trade regulations. This helps prevent illegal trade practices.

- IEC is essential for customs clearance. Customs authorities require this code to clear the shipments. It ensures that goods comply with legal norms.

- Banks demand IEC for processing international trade transactions. The IEC helps banks verify the legitimacy of the transactions and ensures they are in compliance with trade laws.

- The Indian government offers various benefits to exporters. This includes duty drawbacks, export promotion schemes, and subsidies among others. An IEC is necessary to avail these benefits.

- Having an IEC enhances the credibility of a business in the international market. It serves as proof that the business is registered and recognised by the Indian government for conducting import-export activities.

- It helps the government collect and analyse trade data. Accurate data on imports and exports helps the government in making effective trade policies. This improves the country’s trade performance.

Who Can Apply for Import Export Code?

Now that you know what is import export code and why it is needed, let us take a quick look at who can apply for it:

- Any individual who wants to import or export goods for commercial purposes can apply for this code.

- Proprietorship firms, partnerships, limited companies, and trusts dealing in international trade can also apply for IEC.

Documents Required for Import Export Code

Here is the list of documents needed for import export code:

- PAN Card

- Passport size photograph

- Copy of Aadhar Card, Voter ID, Passport or Driving License

- Address proof

- Cancelled cheque

How to Apply for the IEC Code Online in India?

In order to apply and get the Import Export Code in India, there are certain processes to follow. Every applicant must follow these steps.

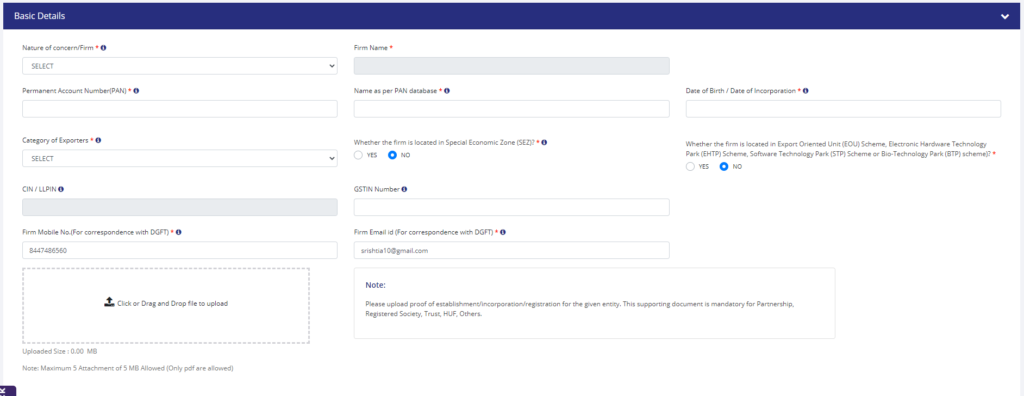

- You need to fill out the application form for IEC online on the DGFT website.

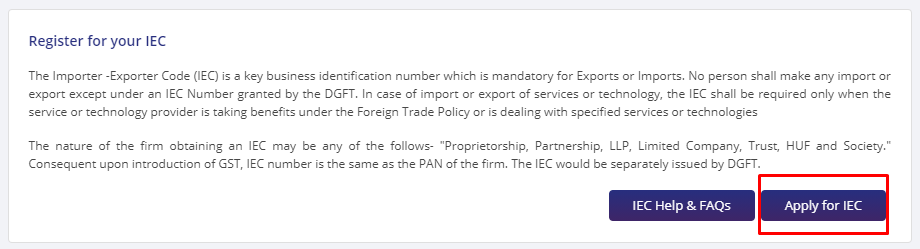

- Go to www.dgft.gov.in and click on ‘Apply for IEC‘

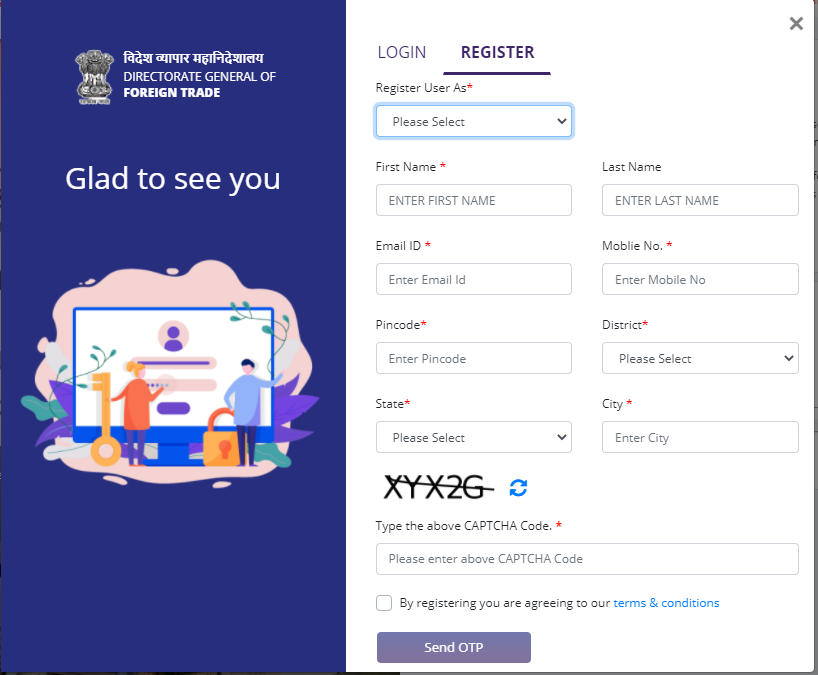

- Fill in all details to register as a new user.

You will receive an OTP on your mobile number and email id for verification.

After verifying your mobile and email, a username and password will be sent to your registered email id. Log in with these credentials.

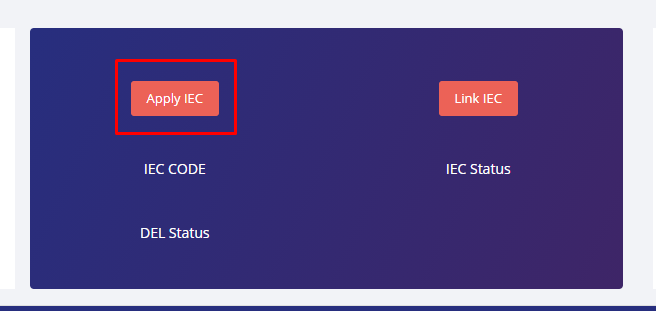

- After you log in to your account, select ‘Apply IEC (Import Export Code)’

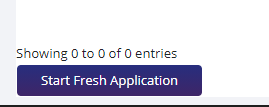

- Next, click on ‘Start Fresh Application‘

- Fill in all details asked and upload the required documents

- After submitting the application, pay the application fee of INR 500.

Post payment approval, you will receive the IEC certificate in your registered email.

After you get the IEC (Import Export Code) code, you can engage in exporting and importing businesses.

What is Import Export Code Validity?

The IEC is valid for lifetime. It does not have to be renewed. However, it is important to keep it updated. Any changes in the bank details, address, or other information mentioned on it must be updated to ensure compliance. You can make the amendments by filling the amendment application on the DGFT website.

In case, you do not want to continue the import-export activities, then you can surrender the IEC. It will be deactivated by the DGFT.

Conclusion

The Import Export Code (IEC) is an essential requirement for anyone interested in operating export import business in India. It is necessary for customs clearance and to gain access to government benefits. Moreover, it enhances business credibility and helps in making effective trade policies. The process to obtain IEC is easy. You can apply for it online in a few easy steps. Submit the relevant documents and pay the application fee online to complete the process.

Can i import anywhere in India if i have a valid IEC?