What is an HSN Code and Why is it Necessary for Shipping?

When you indulge in domestic or international trade, standardized communication along with clarity is key to success. If both parties are not on the same page, there can be massive miscommunication, leading to a poor shipping and delivery experience.

After introducing the Goods and Services Tax (GST) in India, most businesses face a lot of confusion because of the newly introduced terminologies and requirements. The HSN code is one of them.

With this article, let’s understand what HSN codes are, their importance, and how they are used. HSN codes are relevant for your tax invoices, so make sure you understand them correctly. Let’s get started.

What is HSN Code?

HSN code refers to ‘Harmonized System Nomenclature’ or Harmonised Commodity Description and Coding System.

It is a six-digit code that classifies more than 5000 products. These are arranged in a logical structure. HSN codes are accepted worldwide and supported by well-defined rules. These are used in import and export as most nations widely accept them. The HSN code can be 4-8 digits long.

For example, if you are shipping a particular type of paper, it can be known as something else in the country you’re shipping it to. So to avoid this confusion, all the names and the relations are standardized with a single HSN code so that the sender and receiver are on the same terms.

The HSN Code Decoded

The HSN code comprises different parts. Let’s see what the different components of an HSN code are and how it is made.

The first two digits of an HSN code or a chapter. A chapter refers to the second-highest classification in terms of hierarchy in the HSN code.

The next two digits are the heading, and it refers to the headings under chapters.

Following this, two digits are the subheadings after the headings.

Finally, the last two digits explain the product tariff heading during import and export of supply.

How to Create Your HSN Code?

You do not create a new HSN code but assign one to your products with the HSN codes directory.

Under the GST Act, 21 sections contain over 99 chapters divided into 1244 headings and 5244 subheadings.

If you are assigning an HSN code to your product, it must represent the details of your product.

If you want to highlight the local aspects of the HSN code, you can do it using the eight-digit code.

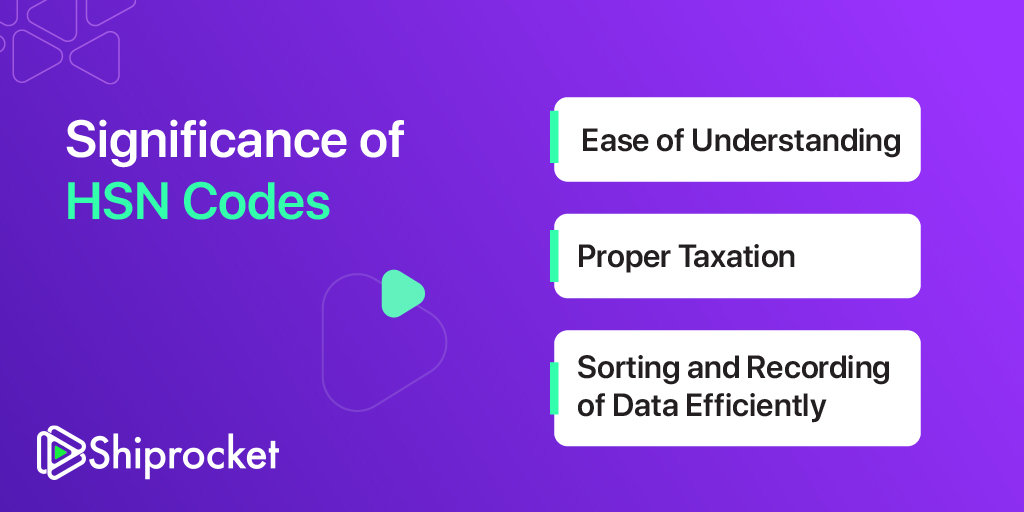

Significance of HSN Codes

Ease of Understanding

As the HSN codes are widely accepted in over 200 countries, they ease understanding and comprehension to both the exporter and importer. If two things mean different in different nations, the correct HSN codes can help standardize the process and bring the two parties on the same page.

Proper Taxation

If the nomenclature is defined, the process can be automated. In India, the HSN codes have a considerable advantage as they help automate the GST taxation process. HSN codes eliminate any scope for misinterpretation and make the process smooth and transparent.

Sorting and Recording of Data Efficiently

When it comes to an import-export business, recording data and analytics are critical to analyzing the success and failure of any strategy.

With each thing ordered so proficiently, it turns out to be amazingly simple to record and sort information in a precise way.

How to Find GST Codes for Your Products?

You can easily find any HSN code by simply Googling it. However, if you need more specifics, follow the below steps.

Go to → https://www.gst.gov.in/

Go to → Services → User Services → Search HSN Code

You will be asked to enter the chapter, name, or code if you have these details. Great! If you don’t, you can download the HSN in Excel format and search there.

Final Thoughts

HSN is a vital classification that simplifies trade for your business. It can help you eliminate confusion and miscalculation and improve your overall shipping experience. Make sure you are well acquainted with this code so you can be on top of your shipping game always!