Customs Clearance: Process, Challenges & Tips

Customs clearance is an essential step in international trade. It permits the transfer of products across borders while guaranteeing legal conformity. 99% of merchants agree that customs clearance is the most complex and critical step in international shipping. It involves several procedures like documentation submission, clearing tariffs and duties, customs valuation, risk management, etc.

This blog provides an overview of customs clearance in cross-border trade and discusses its significance, essential components, and difficulties.

What is Customs Clearance?

Customs clearance refers to examining and clearing goods for legal compliance by the customs authority so that they can leave (export) or enter (import) a country. It can also be defined as documentation issued by the resident customs authority to the shipper.

The customs clearance process is mainly exercised to generate income, protect the nation’s economy and environment, as well as the citizens. Please note that every country has its own customs department and norms a shipper needs to comply with.

Process of Customs Clearance

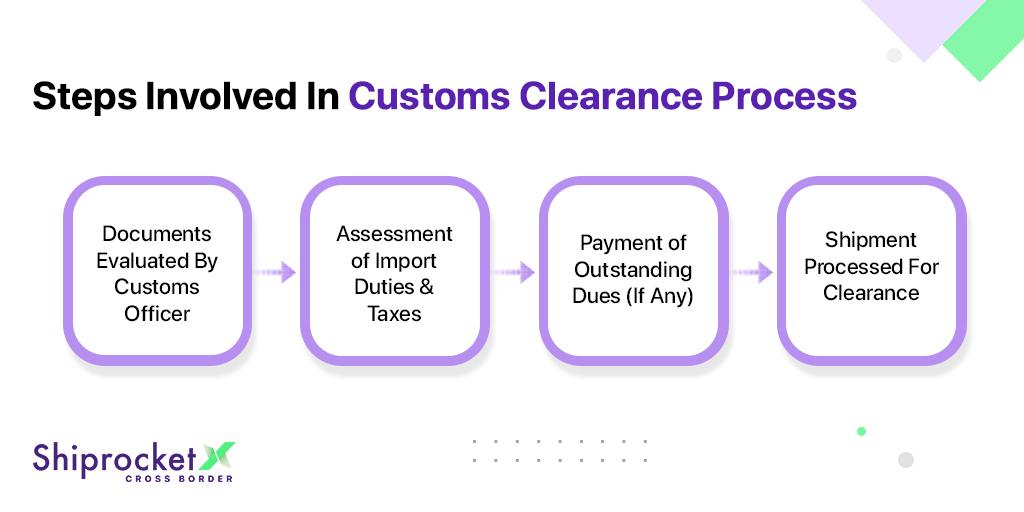

Once a shipment arrives at the customs, here’s what takes place:

- Documentation is examined by Customs Officer

When your shipment arrives at the customs office, specific documents are scrutinised by the customs authority – the shipping label, bill of lading, and commercial invoice. There is a detailed declaration form to be filled out with information such as the name of product, number, and weight of product. The information on the declaration form must accurately match with the information on the formerly mentioned documents, and in case of any discrepancies observed, the clearance process is extended, and you may be charged additional fees for extra screening. In worst cases, unidentified or mismatched data can result in shipments held without returns.

- Assessment of Import Duties and Taxes

Since taxes are calculated based on the type of parcel, their declared value, and the incoterm used, the customs officer checks whether your tax duties have been paid according to the paperwork you’ve submitted. Export duties are assessed on goods that exceed the minimum taxable threshold value.

- Payment of Outstanding Dues, If Any

This is where your choice of incoterm on the document comes into play. If your documentation has DDU (Delivery Duty Unpaid), the customs officer transfers your goods to a customs broker to collect payments, which can be pretty expensive because they include re-inspection, handling, brokerage, storage, as well as delayed payment. If your documentation has DDP (Delivery Duty Paid), customs will clear it for delivery.

- Clearance of Shipment for Delivery

Once the customs officer is satisfied with the examination and verification of your shipment, the exporter receives a green signal for delivery to the end destination. While shipments are rarely held back at customs, there are numerous instances where it gets delayed from clearance. This is mostly because of mismatched documentation and unpaid duties.

- Delivery of Goods

Once you’ve shown the customs paperwork to the port officials, you can pick up your goods. If your cargo’s sitting in a warehouse, you’ll need an extra form called an ex-bond bill of entry. This lets you clear all or part of the cargo stored there.

Documents required during Customs Clearance

For a hassle-free customs clearance process, your parcel must be accompanied by customs declaration document, alongside the following documents:

- Export/Import License: Be it importing or exporting goods into a country, one must apply for licensing authority for seamless movement of goods across borders.

- Pro Forma Invoice: Used as an alternative to commercial invoice in some countries, this is a confirmation document sent to buyer’s after the order has been placed.

- Country of Origin: This document is generally issued by the seller, denoting the region/state from which the goods are acquired, manufactured, or processed from.

- Commercial Invoice: This document is a proof of transaction to both parties, buyers as well as sellers. It includes all crucial information related to the shipment such as names and addresses of both parties, customer reference number, volume and weight of shipment, terms of sale and payment of goods, incoterm, currency used in transaction, quantity, description, unit price, total price, shipment mode, and freight insurance details of the goods.

- Please note that the incoterm decided on by both parties is significant during customs clearance.

- Import Export (IE) Code: This is a key document for import-export activities. It is essential for businesses trading goods or services internationally.

- Export packing list: This document includes detailed inventory of shipment contents, including item specifications and packaging info.

- Certificate of free sale: This certificate proves products are legally sold in the country of origin and okay for export, especially for food and health items.

- Bill of Entry: Importers file this electronically to clear goods. They self-assess duties and taxes. Once approved and paid, it’s entered into ICEDIS, generating a number. Submit documents to port for clearance approval.

- Ocean bill of lading: This is a buyer-seller contract for shipping goods by sea.

- Inland bill of lading: This is an agreement between goods owner and transporter for overland shipping, often to the main ports.

- Air waybill: An air waybill is a receipt from international airline proving carriage contract for goods.

- Shipper’s letter of instruction: This letter serves as the shipper’s guidelines to freight forwarder on shipment handling and routing.

- Letter of credit: This acts as a bank guarantee that the seller gets paid if delivery conditions are met, protecting both buyer and seller.

Checklist to Make the Customs Clearance Process Easier

To make the customs process as smooth as possible, one needs to follow a certain checklist and become familiar with the international trade policies of the country you are shipping to.

- Self Duty Check

Before proceeding with cross-border shipping, you’re your own customs agent. Exporters can self-assess the duty that may be levied on the goods they’re shipping and declare the right classification of these items and their quantity along with the rate of duty.

A claim of exemption, if any, is filled in the shipping bill based on this information. Don’t forget the other paperwork – you’ll need to rustle up insurance documents, packing lists, proof of where your items came from, a bunch of invoices, and more.

- Shipping bills

Exporters need to fill these out online through ICEGATE or ICES. Your bill might get checked, your goods might get inspected, or you might hit the jackpot with a “Let Export Order” and sail right through.

- Post-clearance audit (PCA)

After you’ve shipped, customs might still look at your paperwork. It’s their way of keeping everyone honest and speeding things up.

- Ensure paperwork is updated and 100% accurate

Let’s say your shipment has traveled thousands of miles to a destination country, and has reached right on time! You wouldn’t want it delayed at customs due to incorrect information or additional documentation as per the country norms. For example, some ports do not accept the cargo without the original stamped commercial invoice.

- Keep in check of frequent changes in international trade laws & regulations

Sometimes, rarely than often, international trade laws tend to change, mostly due to inclusion of religious belief, political unrest, or changing governments. For instance, to ship some things in some countries can require the courier company to have an import license.

- Research other required documents for certain product types & countries

Certain countries require additional documentation for the goods to be imported into borders. For example, importers of pharmaceutical drugs are required to submit a Drug Registration Certificate or Drug License Copy for export to some countries.

Simplifying Customs Clearance: Final Thoughts

Shipping internationally takes a few extra miles than domestic shipping, and might seem like the Goliath if you’re new to the export-import industry, but with the right shipping partner by your side, your dilemmas about clearing customs could be at a minimum. From offering easy-print labels for shipments to customs documentation, take the hitch out of your export process with cross-border shipping solutions like ShiprocketX. They provide international shipping to more than 220 destinations. With transparent billing and tax compliance, ShiprocketX assists you in getting customs clearance without any hassle.