Best Practices For Managing Your Cash Flow

The cash flow statement not only manages the amount of money that comes into a company but also keeps track of how much cash it has on hand to pay expenses and buy assets.

Companies should have control over the cash flow statement that is going in and out of their business. You obviously need to have a good grasp of the cash flow that your business has if you are thinking about expanding. To get the estimate of your cash flow it is a good idea to keep your cash flow statements as they demonstrate all of your expenditures.

Naturally, there are types of cash flow that business owners that need to perform on a regular basis. For example, an Inflow of cash is an increase of cash that comes from many transactions like loan repayments, product sales, or any other income streams you have in your business. While, outflow cash is when there is a decrease of cash due to making loan payments, marketing costs, sales costs, paying your staff members, or any other services.

As you can see, managing cash flow is important to keep track of all the inflow and outflow expenses inside the company.

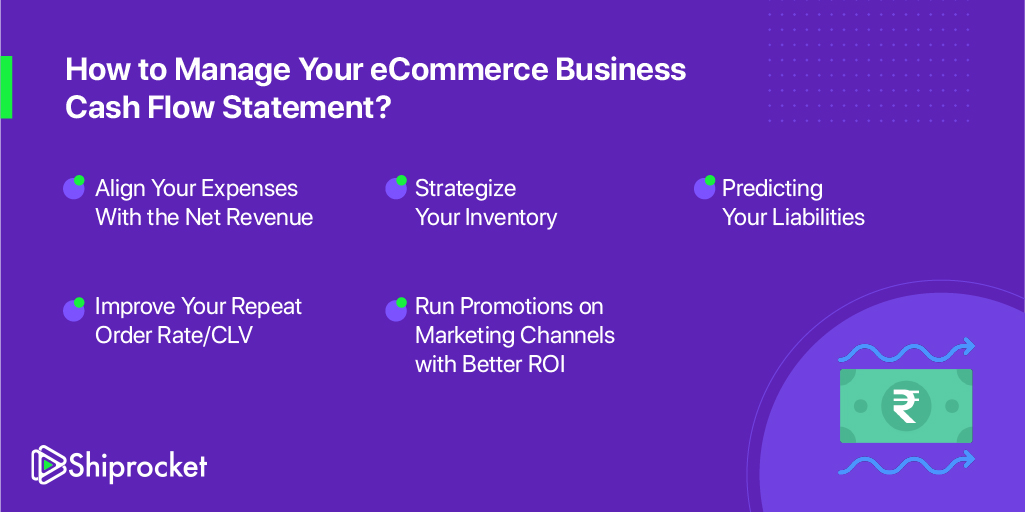

Tips to Manage Cash Flow For Your eCommerce Business

So you can take the necessary steps to manage cash flow problems. Here are common cash flow statements that business owners face and sometimes create that can hurt their business and may lead to business failure.

Reduce Your Expenses

The expenses can happen at any time and can be problematic when starting or expanding a business. You certainly invest in things you may not really need. If you don’t have enough inflow of cash to manage expenses, you need to conduct a critical analysis of your purchase.

You can fulfill your dream of future growth and success when you will generate a lot of money through business. Your customers may not think about what you have to offer to buy your offerings, but they may look at your ability to present and sell your products and services. Regardless of how you manage your expenses, not having the additional flow of money may hamper your business. In an eCommerce business, one of the most straightforward ways to manage cash flow is to make more money and reduce your expenses.

Having a term agreement with your suppliers will give you more flexibility to manage your cash flow. Similarly, you can have a business credit limit with a bank, or other financial institution to borrow money immediately. You can also build your savings to pay for your business expenses or invest in an opportunity.

Inventory Control

Inventory control is the best way to improve cash flow and profitability. Purchasing inventory items requires a cash outlay that affects the company’s cash flow statement. But overstocked inventory items will appear as a negative expense in the cash flow statement. This is why the cash flow of your business is largely dependent on how you manage inventory.

The inventory planner is a key measure to know how well you’re managing your inventory stock and how much is brought and sold within the company’s financial year. The inventory control metrics also allow to meet the high demand and respond to market needs.

If your inventory turnover ratio is on a higher side, the greater your cash flow. And if this ratio is low, it indicates that you are buying inventory faster than you’re selling. Improving the inventory turnover ratio simply helps reduce the cash flow.

Checking Your Liabilities

Your business liabilities are when you pay cash to borrow something for your business, and that borrowing creates a liability on your cash flow credits that must be repaid at some point through other resources.

Take an example, buying from suppliers is a form of expense that represents a liability to your firm unless you pay off the money before the due date. Similarly, getting a bank loan, or mortgage on a business property you own also incurs a liability. Your eCommerce business can also have liabilities from activities like paying employees salaries and others.

Some form of liability is good for a business like investing to acquire new assets, business takeover, expansion, and to get and keep customers. But, too much liability isn’t good for a business. If too much of the cash flow of the business is spent on paying back loans, there may not be enough to pay other expenses such as taxes, salary payments, etc. That’s why it’s important to keep track of liabilities and analyze them.

Liabilities cash flow statement can be shown on your business’ balance sheet that shows the situation at the end of an annual period. Any business can have some problems along the road. A slow cash flow may mean that there isn’t enough cash to manage the expenses. But if you don’t have a track of your liabilities of cash to cover your expenses, your business may suffer quickly.

Improve your CLV or Repeat Order Rate

The repeat order rate or customer lifetime value (CLV) are two important factors that work a lot about managing your cash flow. The improved order rate drives people to shop again and again from your site that shows how loyal they’re to the brand. It also shows how essential your product is for them, how often they buy it, and if you’re the first choice or a substitute.

Top eCommerce brands like Amazon, Flipkart add new and trending products a month to drive frequent orders. Their strategy is to make people visit their online stores to check what’s new for them. With improved CLV there is no need for complex marketing campaigns, just the excitement of getting something new and trending every time makes people buy more often.

Similarly, by focusing on CLV and repeat order rate, you are able to the cash flow statement of your acquisition costs over the customer lifetime. The formula for calculating CLV is this:

CLV = AOV x order frequency per month x lifespan

So it’s clear that the CLV rate impacts your cash flow and helps you manage it better. It is also important for longer customer retention.

Marketing & Brand Promotion

A marketing and brand promotion strategy can create an impact on your cash flow and frequent leads ratio. Branding requires an understanding of your business’s needs, goals, and perceptions of your stakeholders. Consistent branding can increase your cash flow from online and offline sources.

Many businesses struggle to expand their brand because they don’t invest in customer retention. To improve your cash flow it is best to create ways to retain new customers and chances of referral. The main point to focus on is to have a brand retention budget. It means if you have a target number for branding and customers you wish to bring in each month. This way you can know what it costs and how much money is needed to manage the cash flow constraint.

In the End

A cash flow statement can help you deal with irregular flows of business expenses and revenue. This can also help you know whether you have enough inflow of cash to support your growth plan.